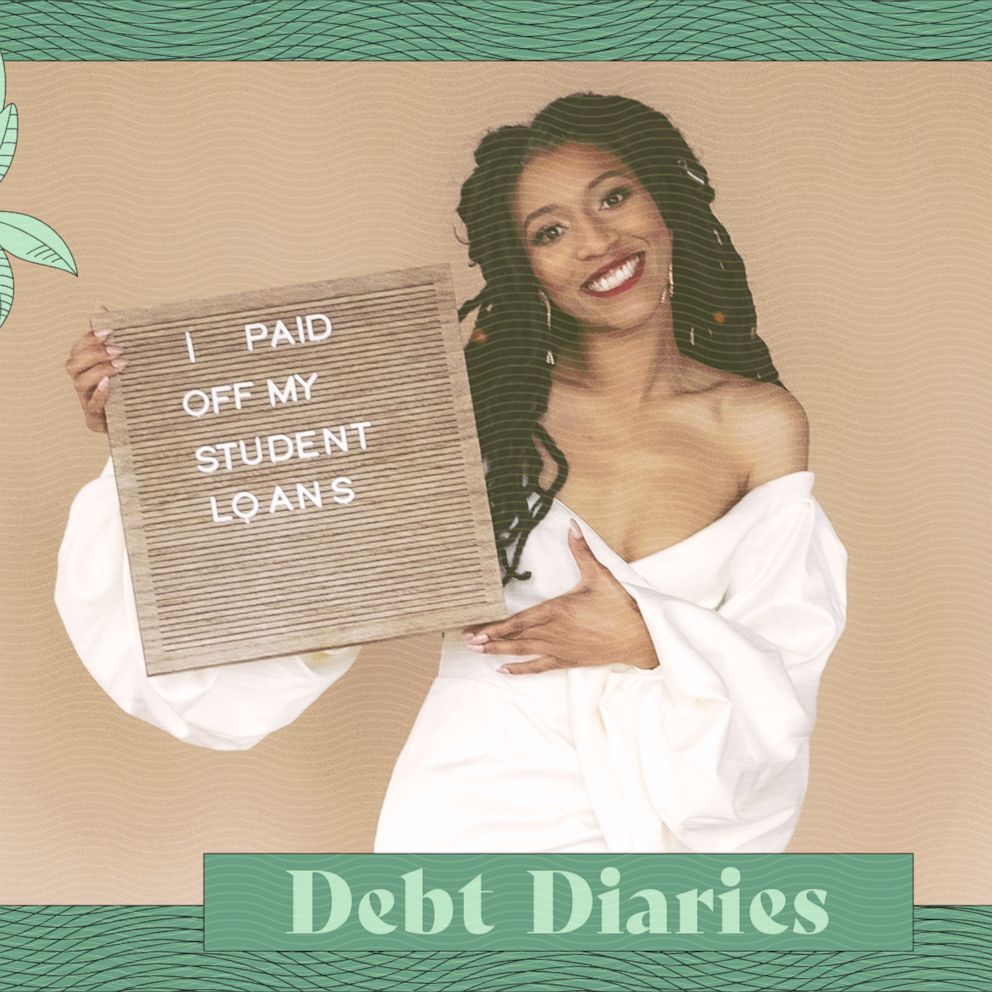

Woman says she and husband paid off $200K debt in 5 years: Here's how

Tinsley Crisp knows what it feels like to be overwhelmed by debt.

At 31, the stylist and writer is now proudly debt-free -- but just a few years ago, she and her husband, Ben, were staring down a mountain of $200,000 in student loan debt.

"It felt like I would never accomplish this goal," she told "Good Morning America" in an interview aired that aired Friday. "I would be paying this off until the day that I died."

The couple initially started with around $30,000 in student loan debt, but when Ben decided to go back to school to become a physician assistant, their total ballooned to $200,000.

According to the Federal Reserve Bank of New York, student loan debt in the U.S. has reached a staggering $1.63 trillion as of the first quarter of 2025.

For many borrowers, the weight of repayment can feel crushing.

But Crisp and her husband, who now works full-time as a physician assistant, decided to take control of their financial future. With the help of a financial planner, the couple created a five-year plan and stuck to it.

"We said, 'This is how much we're making. This is how much debt there is. These are our goals.' And we really laid it all out there," Crisp said.

From there, Crisp and her husband -- who did not disclose their total income to "GMA" -- built a detailed monthly budget and a debt-payoff timeline. Crisp said the financial planner helped them determine how much they needed to pay each month to stay on track.

After five years of what they called disciplined budgeting, intentional sacrifices and unwavering commitment, the couple made their final payment and rewarded themselves earlier this year with a dream trip to Greece.

"To get to that moment and to enjoy that vacation really felt like our dream becoming a reality," Crisp said.

Now, Crisp and her husband are sharing their three tips for paying off debt.

1. Get ultra-specific with your budget

One of the biggest changes they made was learning to budget down to the dollar.

"We really wanted to account for everything," she said. "And I mean, like everything. It came down to, we were planning out when I bought my shampoo and my conditioner. Even if it was $5 a month, just to know that in three months, when I'm probably going to run out again, we would have the money there."

2. Sacrifice now for freedom later

Sticking to their budget meant letting go of a lot of extras, especially travel.

"Whenever we chose to miss friends' weddings, family vacations, maybe even extra trips to visit family just for the holidays, it was tough," she admitted. "And now looking back, I don't regret it at all, because now we're able to do so much more."

3. Ignore the pressure to 'upgrade'

Another key decision she said was to resist lifestyle inflation.

"I was driving a car for over 10 years and I was embarrassed to show up to work with that car," she said. "However, I knew that I would also be embarrassed 10 years later if I was in a similar financial situation because I wasn't responsible with my money at a young age."