How newlyweds paid off over $76K in debt in less than 1 year

In under a year, one couple riddled with debt set out to settle up and they smashed their goal of $76,000 in just 10 months.

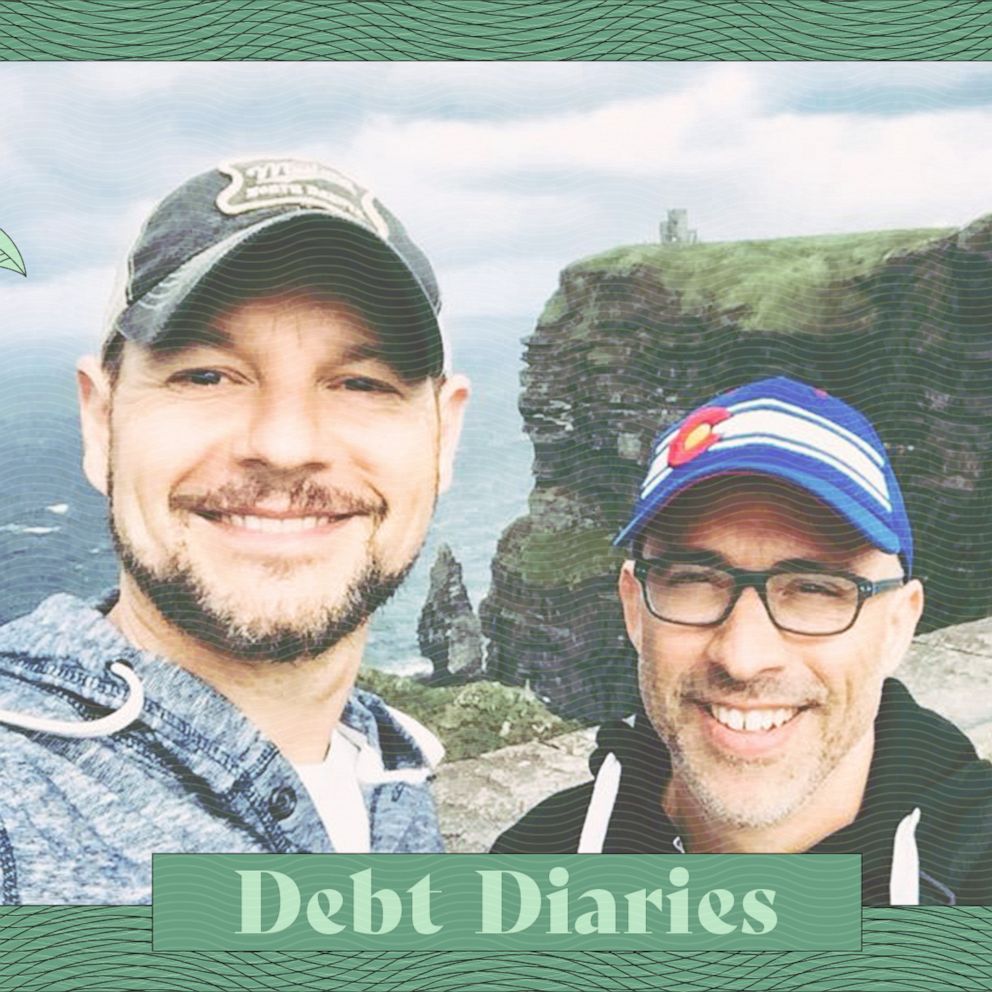

George Lyles and Barclay Bishop Lyles are now debt-free and told ABC News how they got it done despite recent financial hardships.

"We're in bringing in a combined $100,000," George Lyles said. "The big thing was we started off by getting rid of her car."

His wife said it was a "painful" decision, "I did not want to do it, but then I was like, 'If I'm going to sell my car, then George you're going to have to sell your truck," she added with a lagh.

The couple from Augusta, Georgia, who were married in early 2019, faced a number of personal challenges and a threat to George Lyles' job that pushed them close to $80K in debt.

The Lyles said they instead purchased a used car from a family member for cash for under $10,000.

But after putting 75% of their salaries towards their goal of financial freedom, the pair powered through in less than one year.

"We cut those credit cards up and it was like, you just want to throw up. It was awful," Barclay Bishop Lyles said. "It was terrible."

Financial expert with Ramsey Solutions, Chris Hogan, told ABC News how he helped the couple meet their financial goals with three basic rules: focus on what you can control, have a plan for your money and track your progress.

"When you're wanting to get out of debt, you need to know where you're starting, but also the end goal," he said.

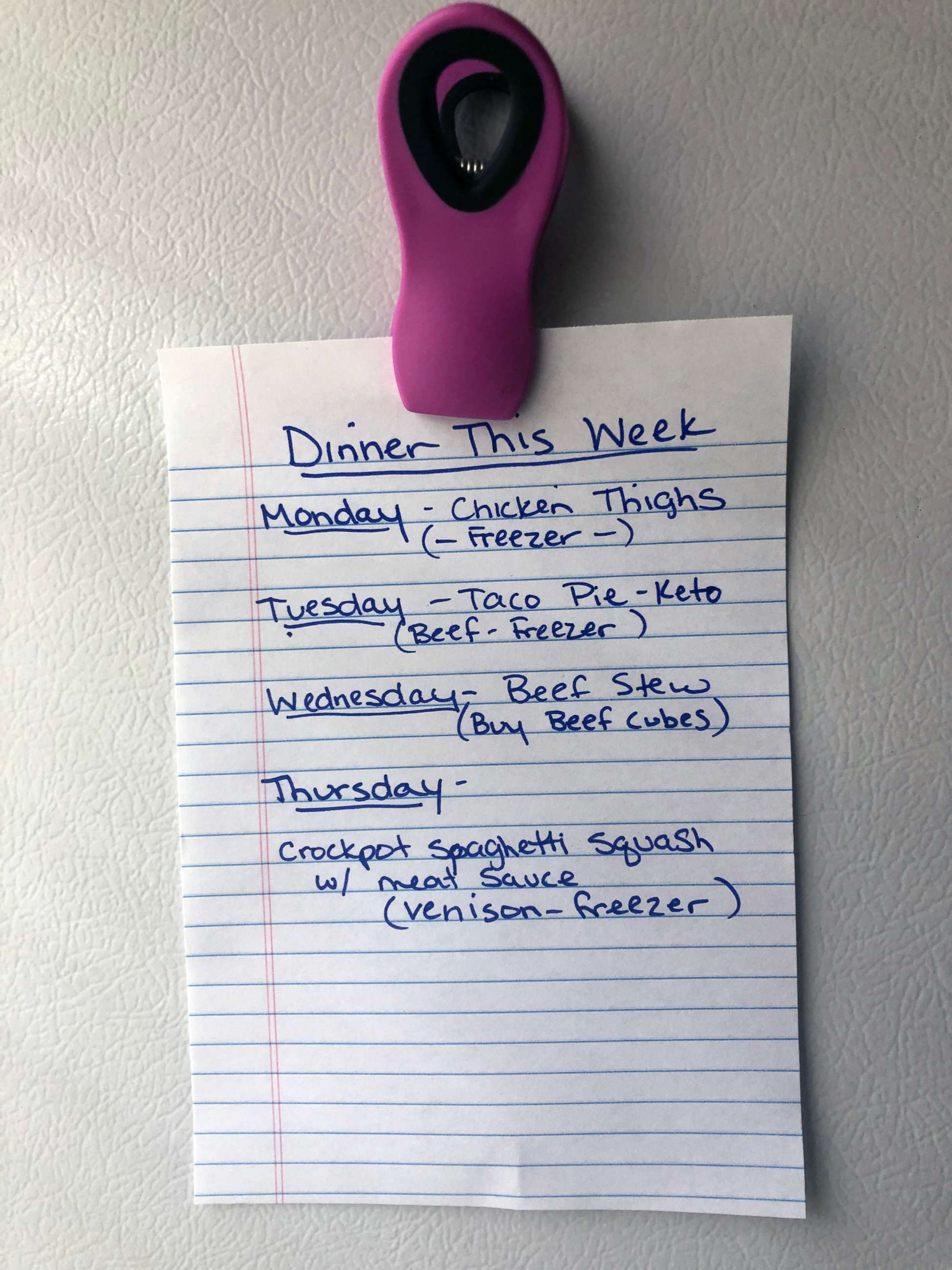

The Lyles said that part of their success was their ability to separate wants from needs.

"It's not easy," George said. "We had a lot of help and mentorship along the way."

In addition to their discipline and setting a long-term focus, the Lyles said it was also important to have some flexibility.

"We still went out and enjoyed time with our friends," Bishop Lyles said. "We budgeted for a puppy. And people thought we were crazy, but we did it smart -- you still have to enjoy your life. You still have to budget for things that will bring you fulfillment in life."

The final aspect of their success story was to have hope.

"I was ashamed because I, I knew we were in so much debt," she said. "You've got to believe that you'll do it."

Hogan, who has helped single mothers, widows and widowers believes everyone can do this with the right mindset shift.

He suggests tackling smaller debts and paying those off first then work up to bigger ones in order to gain a sense of momentum.

Lyles offered another reminder for anyone tackling paying down debt, "people make mistakes, get back on the horse and keep riding."