Couple pays off debt after dream of building vacation home uncovers financial nightmare

According to the credit bureau Experian, there was more than $829 billion in outstanding credit card debt in 2019, with the average consumer owing an around $6,200. In Debt Diaries, we introduce you to those who took on their debt and came away with a better understanding of themselves. Their testimonials offer hope -- and tools -- to show that you, too, can overcome debt.

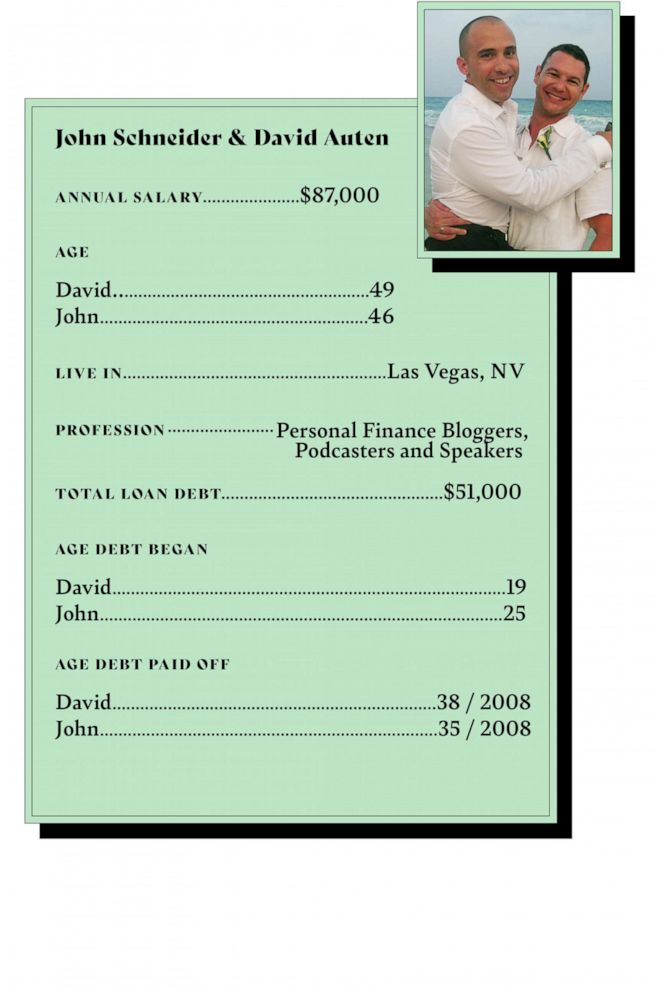

David Auten, 49, and John Schneider, 46, are husbands who worked to pay off about $51,000 in debt that they say came from trying to live a "fabulous life." They share theirs and others' stories as the host of the "Queer Money" podcast, and offer advice on managing personal finances on the Debt Free Guys blog and via the Debt Lasso Method.

How John and David's debt began

DAVID: When I was a kid, we lived in Ireland for a short time period, so when I was 19, my parents agreed that I could go to visit friends. During that time, I went with a credit card that was supposed to be used for emergencies. I came back with a credit card that was completely maxed out and it was because I didn't understand the concept or know what credit cards were really for. From there, I financed almost every aspect of my life and as my income slowly crept up, so did my credit card debt. By the time I met John, I had I think probably around $4,000 or $5,000 in credit card debt, but then the two of us got together and our synergies just blew up my credit card debt. I went to having close to $17,000 at the max and all of that was because I felt the need to "keep up," not just with John, but in general. At one point in time, I remember that I could pay off the balance and then it switched to I couldn't pay off the balance every month.

JOHN: I was more of the big-ticket spender. When I moved out to Colorado and 1999, I had $5,000 in cash in my account to get me started with life after after college. Not more than a year after that, I had $25,000 in debt and that was because I had I wanted to buy the big things, like a brand-new car, new furniture for my apartment and stuff I couldn't afford. And then the traveling. I was addicted to designer clothing. I was acquiring debt after debt, and then David and I met. Financially, we were engines to each other because neither of us knew how to put the brakes on.

Descending into debt

DAVID: Both of us were, on a regular basis, getting either a promotion or some sort of increase in our salary. It just triggered this cycle in our brains that we could spend more. We didn't think about saving more or investing more or paying off our debt. Our lifestyle just kept getting bigger and bigger, and the sad thing is, we didn't have anything to show for it.

One weekend, we went up to the mountains in Colorado to visit a friend of John's in this little mountain ski town of Winter Park. We both love outdoor sports and skiing, and we said we could see ourselves being there more. On our way out of town, we went to a real estate office, we were looking at land and property. We had this idea in our head that we would buy land and build a house. Then we started to talk about how maybe it wasn't a good idea for us to buy land and build a house. As we kept on driving, our conversation changed to maybe we should be thinking about just going up there for vacations. By the time we got to Denver and pulled up to our place and opened up the door, we walked down a flight of stairs into a basement apartment. That was the point where we realized that we had gone from this fantasy conversation about buying land and building a house to living in a basement apartment. Not that there's anything wrong with basement apartments, but for where we wanted it to be in life, it symbolized exactly the way we were living: digging ourselves deeper and deeper.

JOHN: I think the big contradiction was that here we were thinking about buying and building a vacation home when we actually didn't own a home to vacation away from. We were renting an apartment. Simultaneously, a lot of our straight friends at the time we're buying houses and building homes and having children. And here we were in our mid-30s, like, OK, when is this party ever going to end and when are we going to actually have the true lifestyle that we want? We realized we were looking around this basement apartment with a couple of nice pair of jeans and that's about it, and we thought we should be further along in our financial lives and have much more stability than we had at that point. That was really the catalyst for us saying something's not working here.

Developing a plan of action

DAVID: That night, we sat down on the floor of our apartment and had this long conversation, and we came clean to each other about where we were at financially. We had not had that financial discussion before that and that's when we said this is not the life that we want. We could literally see ourselves being in the exact same spot five years later if we didn't make any changes.

JOHN: There are basically three big steps, big changes that we made after David did an analysis. The first was that we stopped going out as much -- we realized we couldn't afford to go out six nights a week or accept every invitation we received. The second thing was we got militant about our grocery shopping and our dining out, reining those in drastically. Third, we figured out the Debt Lasso Method, where we lowered our credit card interest rates down to zero. All that money that we were able to save from week to week and month to month from not going out as much, by not spending such ridiculous amounts of money on groceries and not paying such high interest rates we funneled all that money towards the principle of our credit card debt to expedite paying off our debt as fast as possible.

DAVID: The thing that the spending analysis opened our eyes to was here we were living a "fabulous life" from the outward appearance, but at the same time, we didn't feel like we had a fabulous life. When we started to look, we were like, "Wow, why are we spending so much money on these different things?" In 2006, there were some weeks where the two of us were spending $400 a week on groceries and $400 a week dining out. That's more than the average family of four spends today. We just got sucked into this lifestyle of this is the way we needed to live. When we went out, we had to have a $60-$80 bottle of wine every time. What was once the treat became the habit.

JOHN: In our spending analysis, clearly designer clothing, travel and dining out were the most important things in our lives. But when we realized what we truly wanted, they weren't. We wanted to give back to our community, but, anytime that we did give back to our community, especially financially, it always hurt us in the long run. It doesn't really help the community overall if we're helping one group of people only to penalize ourselves. And then we wanted to see for a comfortable retirement, but we had negative equity and weren't on a path to having any any retirement let alone a comfortable retirement.

Little steps lead to a big payoff

DAVID: Right there at the peak, when our credit card debt was $51,000, we were spending about $10,000 a year on credit card interest. That's the reason why the Debt Lasso Method came about was because we said if we keep on having to pay $10,000 every year, we're never going to be able to get this balance to go down. I think when we realized that we were the ones in control of all this, that this wasn't because of some outside force. We were so unconscious about our spending when we started to realize that we could take back that power. We started to see the progress in lots of little aspects of our lives.

JOHN: It's an important factor if you're paying off debt or you're trying to achieve any financial goal -- you definitely have to make it fun. You can't say I'm just gonna stay inside, quarantining yourself to pay off credit card debt doesn't work. We oftentimes recommend to people to set up milestone rewards: What are affordable things that you can celebrate when you reach certain goals and not anything that's going to put you back into financial ruin?

We synced our last credit card payment with attending my best friend's wedding in Playa del Carmen, Mexico. So, after we returned from Mexico, we had no credit card debt, including no debt from Mexico. With all our extra money from not paying debt, we saved to buy a condo, increase our retirement contributions and further padded our emergency savings. We definitely launch our business. Having no debt, decent retirement savings and extra emergency savings let us both quit our W-2s to work for ourselves more easily and sooner than we ever world have otherwise. We're working hard to have "extra money" again.

Their message to you

DAVID: Whenever you start this process, you cannot look back and get angry at yourself or blame yourself or pile a bunch of guilt on yourself. I like to say that credit card debt anchors your future earnings to your past. So what you're earning today is already been spent, right? But as you start to make changes, you're going to start to reclaim your future. And that's what you need to start thinking about is where is your future? Where do you want your future to be? That can be your motivator. You're gonna make mistakes along the way.But you have to create a plan or get a plan or sign up for a plan and stick with the plan.

JOHN: One of the first exercises that we did was figuring out what our our hopes and dreams were. If you're not 100% crystal clear on what those for you, it can make whatever mistakes you made in the past or whatever goals you set forward that much more challenging. Figure out what those are, and focus on the bigger picture and what your goals are, and eventually, you'll get there.

Editor's note: This was originally published on June 30, 2020.